excise tax division nc

PRIOR WRITTEN NOTIFICATION REQUIRED FROM NC CUSTOMERS. Excise Tax Division - Contact Information Update Form.

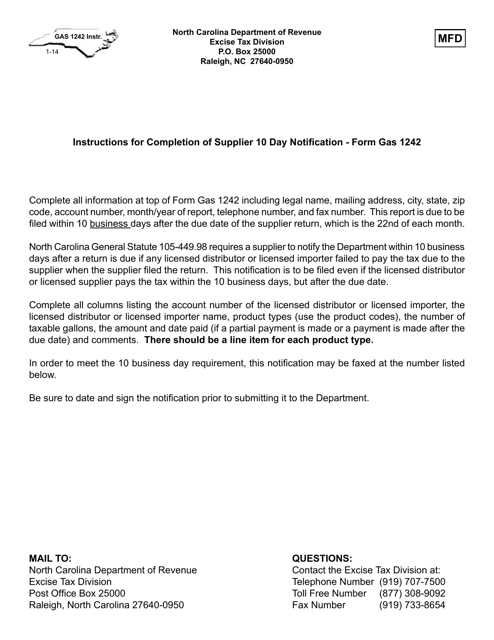

Download Instructions For Form Gas 1242 Supplier 10 Day Notification Pdf Templateroller

North Carolina Department of Revenue.

. Default sorting Sort by popularity Sort by average rating Sort by latest Sort by price. Chapter 04 consolidated License and Excise Tax Division. Federal excise tax rates on various motor fuel products are as follows.

17 NCAC 04A 0101-0108. Raleigh North Carolina 27604. Internal Revenue Code 4121 imposes an excise tax on coal.

In an effort to ensure taxpayers contact information is valid and up to date the Department of Revenue Excise Tax Division is requesting that registered Excise Taxpayers submit their updated contact information. The controlling statute GS. Get Nc Department Of Revenue Excise Tax Division Form.

Contact the Excise Tax Division at. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Low to high Sort by price.

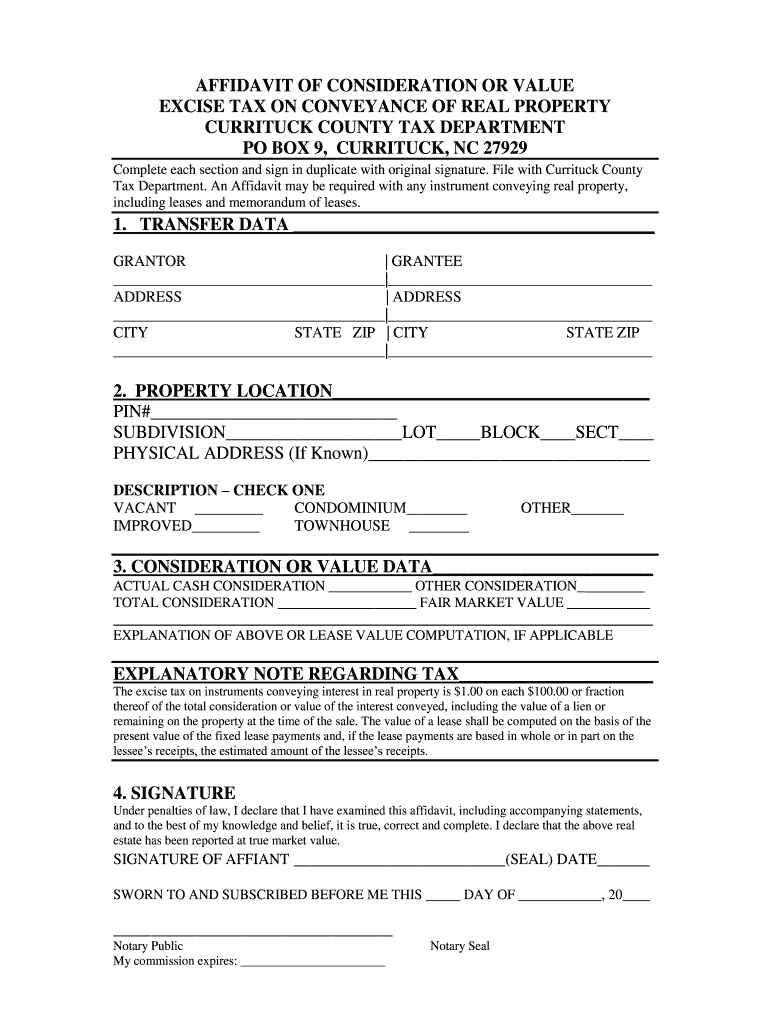

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Excise Tax Division Tax Administration North Carolina Department of Revenue 1429 Rock Quarry Road Suite 105 Raleigh North Carolina 27610 December 2019. Mail the return to the north carolina department of revenue excise tax division p.

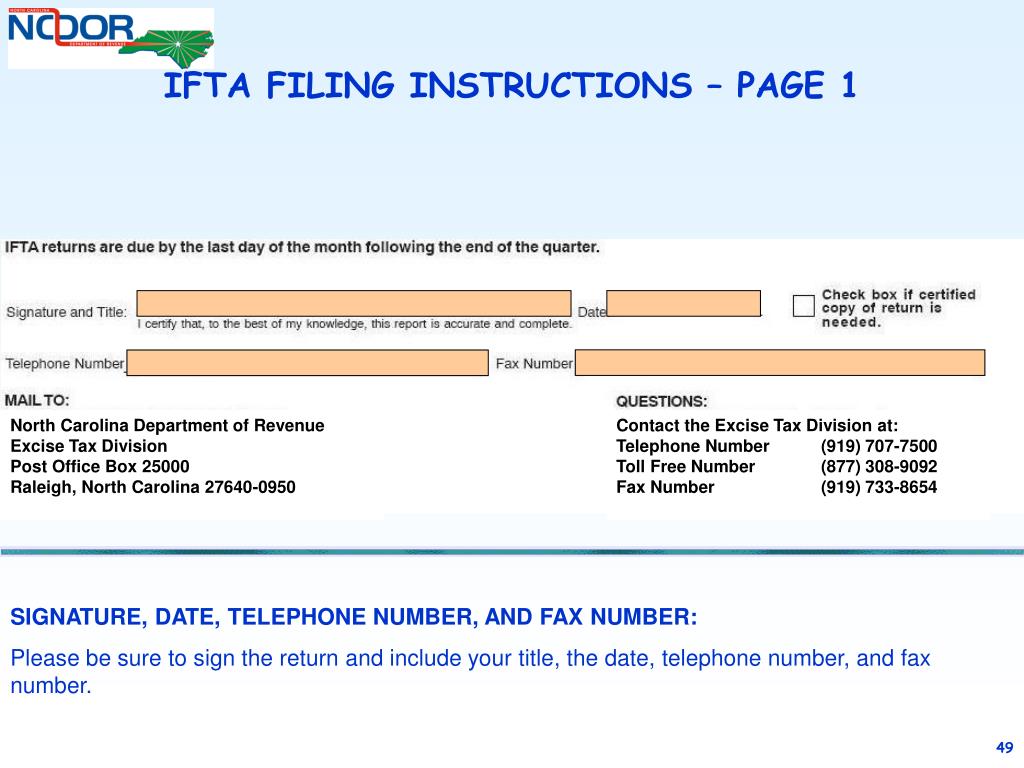

PO Box 25000 Raleigh NC 27640-0640. If return is on time but underpaid 10 of tax due or 50 whichever is greater is due. If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of.

105-22830 provides that the excise stamp tax on conveyances is computed on the consideration or value of the interest or property conveyed exclusive of the value of any lien or encumbrance remaining thereon at the time of sale The deed in question recites that as a portion of the consideration of the. If your business will be incorporated in north. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes.

The state of north carolina charges an excise tax on home sales of 200 per 100000 of the sales price. Excise Tax on Coal. 17 NCAC 04C 1704.

Telephone Number 919 707-7500 Toll-free Number 877 308-9092 Fax Number 919 733-8654. Careers at the Commission. Who is responsible for paying the state excise tax.

NEW 5 CENTS PER MILLILITER ML ON CONSUMABLE VAPOR PRODUCTS EFFECTIVE JUNE 1 2015 This in respect to our wonderful politicians who believe in freedom choking and compared to Indiana or Ohio is not so bad. Mail the return to the North Carolina Department of Revenue Excise Tax Division P. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

North Carolina Department of Revenue Excise Tax Division. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities. North Carolina Department of Revenue Excise Tax Division Post Office Box 25000 Raleigh North Carolina 27640-0950.

About the NC ABC Commission. 1 2020 Information Who Must Apply Cig License. State of North Carolina PRIVILEGE LICENSE TAX Issued by.

The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the consideration or value of the interest conveyed. 105-11380 and 105-11383 ncleggov or contact the Department of Revenue. Excise Tax Division North Carolina Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0001 wwwncdorgov IMPORTANT NOTICE.

Box 25000 Raleigh NC 27640-0950. What is the state excise tax rate. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

The price of all motor fuel sold in North Carolina also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. The Excise Tax Division of the North Carolina Department of Revenue is moving from our current address located on Rock Quarry Road in Raleigh North Carolina to the following address. Home North Carolina NC State NC Department of Revenue Excise Tax Motor Fuel 2022-23 License Exam Classifications North Carolina NC State NC Department of Revenue Excise.

The excise tax is deposited in the black lung disability trust fund. Small business self employed specialty division. The tax rate is one dollar 100 on each five hundred dollars 50000 or fractional part thereof of the consideration or value of the interest conveyed.

HTML DOC. North Carolina Department of Revenue Excise Tax Division 1429 Rock Quarry Road Suite 105 Raleigh NC 27610 Telephone. North Carolina Department of Revenue.

Only complete this form if your contact information such as address email. Individual income tax refund inquiries. Excise tax division raleigh nc.

NCAC Title 17 - Revenue Chapter 04 - License and Excise Tax Division. 8772523052 corporate and franchise tax sales and use tax registration other taxes excise tax division. North Carolina Department of Revenue Waives Diesel Fuel Penalty Due to Hurricane Florence.

Showing the single result. The excise tax division of the north carolina department of revenue is moving from our current address located on rock quarry road in raleigh north carolina to the following address.

Fillable Online Dor State Nc Nc Department Of Revenue Excise Tax Division Address In Raleigh On Rock Quarry Rd Form Fax Email Print Pdffiller

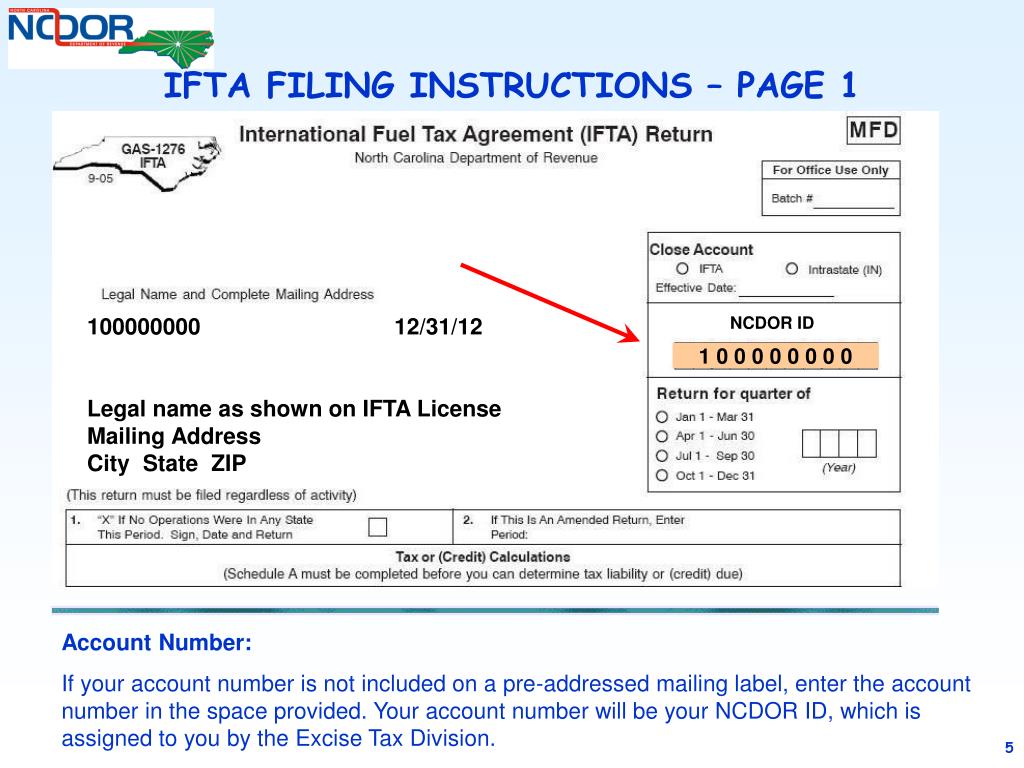

Ppt Completing An Ifta Tax Return Powerpoint Presentation Free Download Id 527733

Ifta Newsletter 2011 March State Publications I North Carolina Digital Collections

Us Treasury North Carolina Provide Excise Tax Relief Wine Beer More

Nc Affidavit Of Consideration Or Value Excise Tax On Conveyance Of Real Property Fill And Sign Printable Template Online Us Legal Forms

Sales And Use Tax Technical Bulletin Section 46 Nc Department

North Carolina Department Of Revenue Directive

Download Instructions For Form Gas 1242 Supplier 10 Day Notification Pdf Templateroller

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Completing An Ifta Tax Return Revised 12 12 2 Overview Completing The Ifta Return Appropriate Rounding On The Ifta Return Surcharge Jurisdictions And Ppt Download

Ppt Completing An Ifta Tax Return Powerpoint Presentation Free Download Id 527733